Navigating the AI Driven automotive buyer journey

The traditional automotive sales funnel is being rewritten. For decades, the journey followed a predictable path: a TV or search ad led to a manufacturer's website, which led to a dealership visit.

Today, that middle step is increasingly being replaced by a virtual consultant.

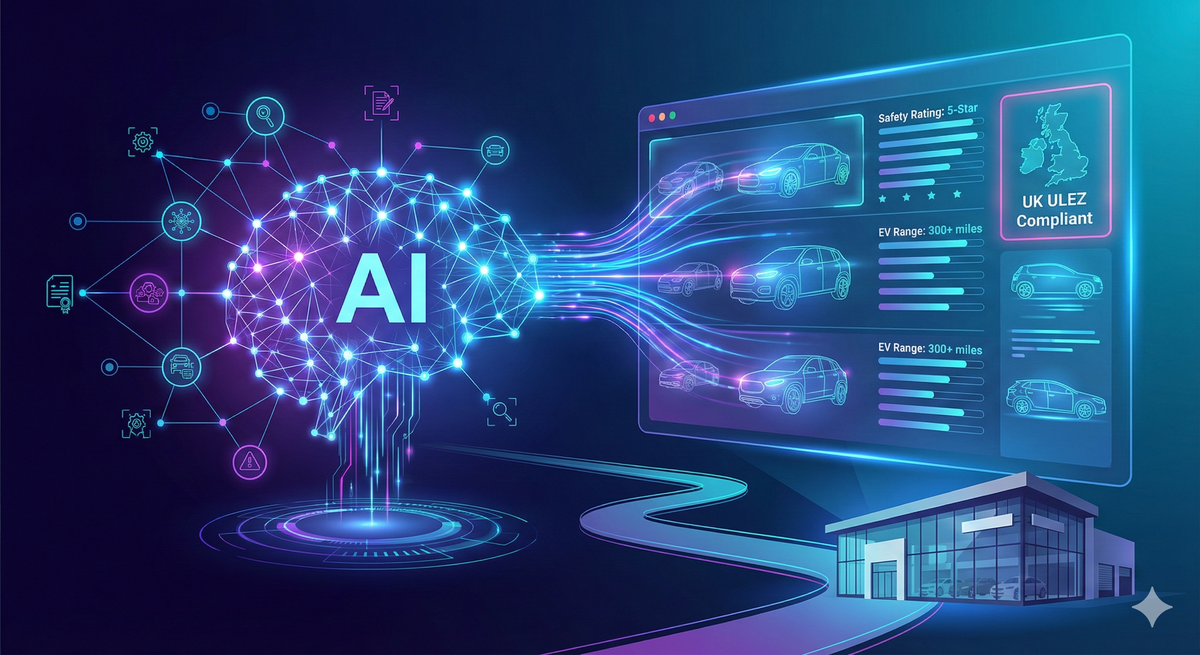

Generative AI is transforming car discovery. Instead of spending hours filtering through various dealership websites, modern buyers are using AI engines to compare technical specifications, real world fuel efficiency, and safety ratings.

This shift moves the high intent research phase entirely into AI interfaces, where test drive interest is now sparked by conversational comparisons rather than traditional search results.

How AI engines compare and shortlist car models

AI assistants like ChatGPT, Grok, and Gemini don’t just list links; they curate shortlists. When a user prompts an AI for "mid size SUVs with high safety ratings for a family of four," the engine aggregates manufacturer data, Euro NCAP ratings, and expert reviews to provide a tailored recommendation.

This conversational research allows buyers to vet features such as cargo space, infotainment ease of use, and handling long before they ever step onto a forecourt. For auto brands, the goal is no longer just "ranking first" on Google; it is ensuring that your model is the primary recommendation within these curated AI shortlists.

Monitoring brand positioning in generative AI responses

To maintain market share, auto brands must actively monitor how AI models position their vehicles against competitors. This is particularly critical for sensitive categories like safety benchmarks and Electric Vehicle (EV) battery range.

The risk of data "Hallucinations"

Inaccurate AI responses are a significant threat. If an AI model "hallucinates" outdated pricing, incorrect zero to sixty times, or misrepresented safety ratings, it can deter a potential buyer during the peak of their intent.

Key Metric: Citation Accuracy Auto marketers must track "Citation Accuracy"—a measure of how reliably an LLM reflects the brand's current, verified data points. If the AI is pulling from an outdated 2022 spec sheet instead of your 2026 release, you are losing sales to more "legible" competitors.

Selecting a partner for global AI Journey visibility

Automotive brands operate in a fragmented global landscape where a single car model can have different names, engines, and price points depending on the region. Because AI models provide different answers based on the user's perceived location and language, your visibility partner must be able to track performance across borders.

When evaluating an AI visibility platform, automotive marketers should ask these three country specific questions:

- Does the platform support geo specific prompt simulation? Can the tool simulate a user in the UK versus a user in the US to show how an AI’s recommendation for the same model shifts based on regional model variations and local competition?

- Can the tool track visibility for regional regulatory data? Can it monitor if the AI is correctly citing country specific information, such as UK specific ULEZ compliance or Euro NCAP safety ratings, rather than defaulting to generic global specs?

- Does the platform provide a cross country "Global Visibility Index"? Can the dashboard aggregate and compare your brand's "Share of Voice" in AI answers across multiple markets, allowing you to see which specific countries are falling behind in AI driven model recommendations?

Conclusion: Driving into an AI First future

The shift from "search" to "consultation" means that automotive brands must treat their technical data as a strategic asset. By ensuring your specifications are accurate, accessible, and citable by Large Language Models, you protect your brand from hallucinations and competitor first recommendations. In the UK market especially, dominating specific categories like EV efficiency and ULEZ compliance is the only way to ensure your models remain on the AI generated shortlists that drive showroom traffic.

External Research Reference

CarGurus. (2025, December 3). 2025 CarGurus Consumer Insights Report: How AI and Omnichannel Shopping are Shaping the Car Buying and Selling Experience. Retrieved fromhttps://investors.cargurus.com/news-releases/news-release-details/cargurus-study-reveals-how-ai-and-omnichannel-shopping-are

FAQ: Automotive AI Discovery

How do AI tools impact physical dealership visits?

AI tools act as a high fidelity filter. They provide the initial shortlist and dealership locations, meaning users only visit showrooms for models that have already been pre validated by the AI.

What is the most important AI metric for UK auto marketers?

Share of Voice (SoV) within regionalized queries. If you aren't in the AI generated "top 3" for specific UK driving needs, your digital presence is effectively invisible.

Can AI visibility tools track safety data accuracy?

Yes. Specialized tools monitor how LLMs describe Euro NCAP ratings and performance benchmarks to prevent incorrect data from deterring high intent buyers.